Senior Living Costs by State

Curious what states have the cheapest or most cost-effective senior living near you? Let’s break down exactly where each state falls on the index of price and why that may be.

From various economic pressures like inflation and industry dynamics like labor shortages, operating cost increases and rising insurance rates, like everything else, the national costs associated with all long-term care service providers have seen increases over the past few years, according to recent data by The Genworth Financial Tool.

Assisted living communities have increased an average of 18.89% since 2021, but the increase from 2022 to 2023 was only 1.36%. Since 2022, nursing home costs have increased 4.40% – 4.92% depending on the room type. Homecare and homemaker services costs have increased by 7.14% – 10% in 2023 compared to Genworth’s 2022 data. When compared to 2021 data, the costs have risen by 15% -22%.

Costs are Levelling. Demand is Rising.

Senior living communities provide active lifestyles, maintenance-free living, social activities, opportunities to engage, support and assistance if it’s needed, and peace of mind for both residents and families. They provide lifestyles that are hard to match at home. Having a sense of community and waking up each day to a vibrant life can make a significant difference in quality of life – which may explain why, since the end of the pandemic, seniors are once again choosing community living.

The National Investment Center for Seniors Housing & Care (NIC) analytics outlook for 2024 predicts “notable improvement” in stabilized occupancy distribution by the end of the year. Specifically, the report reveals an expectation that 85% of senior living communities will achieve occupancy levels of 80% or higher, slightly exceeding 2019 figures.

Overall, the current average occupancy rate is just 1.5% behind the pre-pandemic high at 87.1% seen in the first quarter of 2020. According to NIC, the senior living industry is on track to regain pre-pandemic average occupancy some time in 2024.

How Much Does Senior Living Cost? It Varies — Greatly.

Whether it’s independent living, assisted living, memory care, skilled nursing or homecare, as you might expect, costs vary widely across the country. Price differences are typically driven by factors such as local cost of living, the cost of underlying real estate, the availability of communities, amenities, services, along with state-specific development, healthcare policies and regulations. Overall, states in the Midwest and South tend to offer more affordable senior living options, while states in the Northeast and on the West Coast generally have the highest costs.

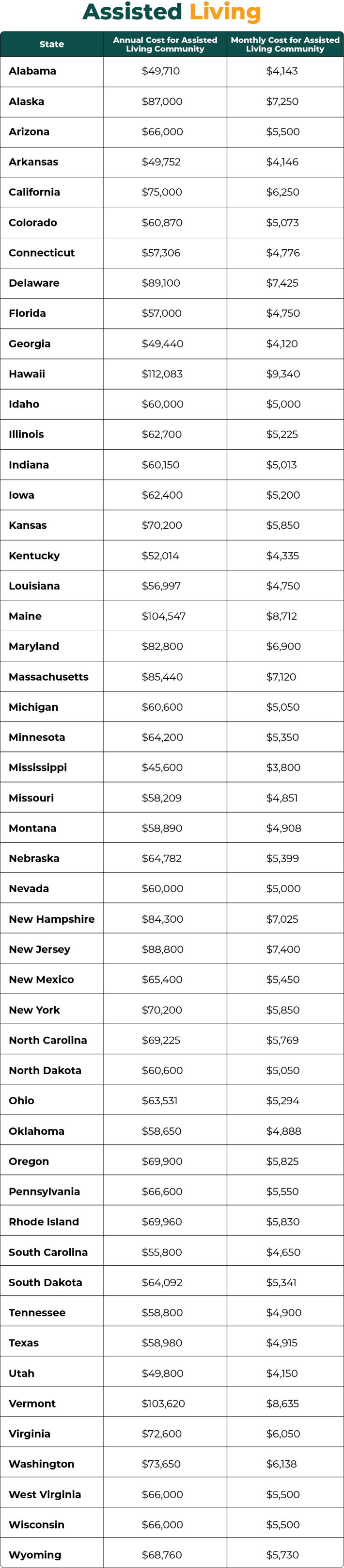

How Much Does Assisted Living Cost in Your State?

Genworth reports that the monthly median cost of assisted living in the U.S. is $5,350. Influenced by factors such as location, size, amenities, and level of care provided, states like New York, Massachusetts, California, and Washington typically have some of the highest costs due to higher living expenses and demand for senior care services. On the other hand, the Midwest and Southern regions often offer more affordable options. States such as Oklahoma, Arkansas, and Tennessee are known for lower assisted living costs.

Monthly Memory Care Costs

Memory care communities are often located within assisted living communities. But base assisted living costs often don’t cover memory care expenses like special dementia training for staff or secure wings to prevent wandering. The National Council on Aging (NCOA) reports the extra staff qualifications and communities required explains the difference in the average monthly cost of memory care—$6,935 according to NIC —compared to $5,350 for assisted living.

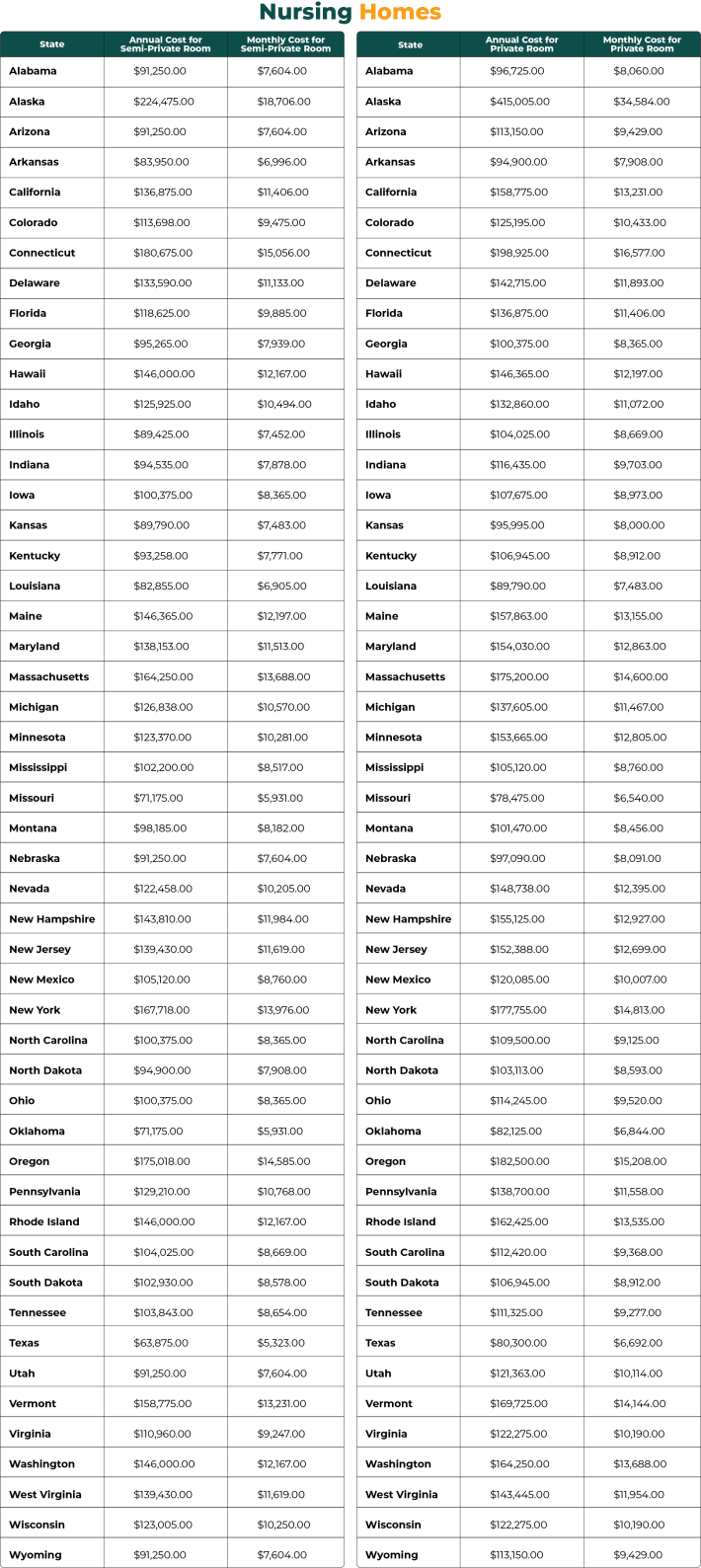

How Much Does Skilled Nursing Cost in Your State?

The cost of skilled nursing care also varies significantly across different states, reflecting regional economic conditions, the quality of communities, and the levels of care provided. According to Genworth, the national average monthly cost is $8,669 for a semiprivate room and $9,733 for a private room. In states like New York and California, where the cost of living is high, expect to pay more. Conversely, states with a lower cost of living, such as Arkansas or Mississippi, offers skilled nursing care at a more affordable rate.

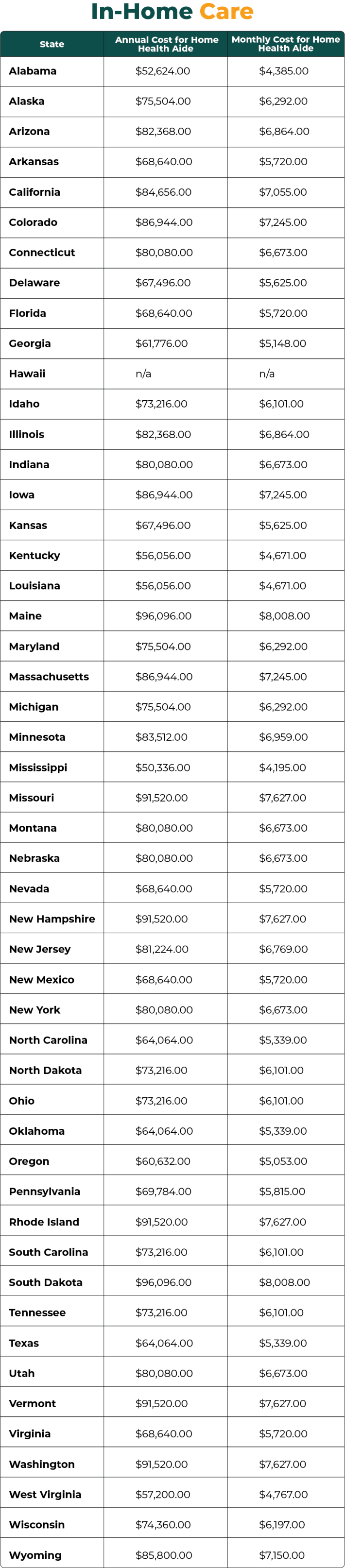

How Much Does Home Care Cost?

The cost of in-home care for seniors can be expensive, though it can sometimes cost less than the average price of assisted living depending on the amount of hours care is needed, your state and your family’s expectations. However, for many seniors, when a modest level of home care is required and added to the cost of a home, home operation and living expenses, the cost of living at home with home care – even for a modestly priced home – can exceed the cost of some senior living communities.

The Genworth survey states you can expect to pay $5,720 per month for a home health aide (based on 40 hours per week).

How to Pay for Care?

Not knowing how to cover senior living costs is often a roadblock to moving forward and enjoying a lifestyle that’s more affordable than you think. Fortunately, there are many options to help you pay for the lifestyle and community best for you. Here are some examples of how many families pay for senior living.

Is Aging in Place at Home a Cheaper Option? Not Really.

Ask anyone age 65 and better if they would prefer to stay in their own homes and age in place rather than go to a senior living community and the answer is often “yes.” But there’s a cost to aging in place. Here are some things to consider when comparing senior living costs to remaining in your house:

Use this convenient cost comparison worksheet to compare the cost of assisted living to remaining in your house.

Finding the Option that’s Right for You.

Finding the option that’s best for you at a price you can afford will require some homework. Talk with a financial advisor, crunch numbers, read the fine print in senior living contracts, ask friends, and most importantly, visit communities to find the solution that fits your needs, goals, and budget. Find a community near you.

Where You Live Matters

Where You Live Matters is powered by the American Seniors Housing Association (ASHA), a respected voice in the senior housing industry. ASHA primarily focuses on legislative and regulatory advocacy, research, and educational opportunities and networking for senior living executives, so they can better understand the needs of older adults across the country.

Originally Published: January 27, 2016 – Updated On: July 19, 2024